Electric vehicles accelerating

The vehicle manufacturing industry is currently undergoing a severe and radical transformation in a sustained bid to bring an end to selling cars and vans powered by petrol, diesel and gas engines throughout the European Union by 2035

Last July, the European Commission approved its “Fit for 55” package, which aims to reduce CO2 emissions from cars and vans by 55% by 2030 and to zero by 2035. In practice, this means that from 2035 it will no longer be possible to sell these types of vehicles with internal combustion engines (petrol, diesel and gas) in the EU. The Commission estimates that nine out of ten cars sold in 2035 will be fully electric and the remaining 10% hydrogen-fuelled. The regulations proposed by the EU executive do not affect the second-hand market, but anyone buying this type of vehicle must take into account traffic restrictions, which are stiffening, such as the ban on entering low-emission zones.

For now, it remains only a proposal that needs to be negotiated with member states. The major exporters of vehicles, Germany and France, have called for postponing the measure until 2040.

Some manufacturers do not hide their scepticism regarding the viability of this scenario taking place in such a short time. A few months ago, BMW CEO Oliver Zipse stated that his brand does not intend to stop developing internal combustion engines, given forecasts stating that “the demand for vehicles with a internal combustion engine will remain solid for many years.” That being said, this group is one of the most active in the electric vehicle market, and predicts that by 2030 half of car sales will be electric. Mini, one of its brands, will present its latest combustion engine in 2025 and expects half of its sales to be electric cars by 2027 (they have been at around 15% since the beginning of 2021) and for the entire Mini range to have become electric by 2030.

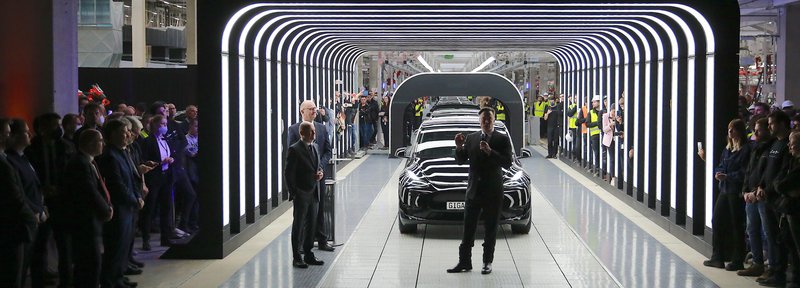

Tesla, which has manufactured only electric vehicles since its inception in 2003, opened its first plant in Europe on March 23, a gigantic factory on the outskirts of Berlin, with a production capacity of 500,000 vehicles a year and which is only producing the brand’s compact electric SUV, the Model Y Performance, which costs 70,000 euros on the Spanish market.

Another brand that is already fully electrified is Smart, from the Daimler group, which has only sold cars of this type since 2020: the Fortwo EQ and Forfour EQ. Daimler was set to end production of combustion engines in 2039, but the European Commission’s plans have now forced the company to bring its deadline forward. A similar situation is that of Ferrari: last year, then-CEO Louis Camilieri said he did not believe the firm should ever become a 100 percent electric brand, but it is rumoured that in 2025 we will see the first electric Ferrari. Whether it stops producing combustion engines is another issue altogether, since it has a large market in America and Asia, where there is none of the European rush to stop CO2 emissions.

As for other manufacturers, many have already announced that they will have done their homework by 2035, and in some cases total electrification will even take place before 2030. The Stellantis group has an electrical plan for its 14 brands that envisages the conversion of Opel into a one hundred percent electric manufacturer in 2028, while by 2024 it expects to have at least one electrified version (one hundred percent electric, hydrogen or plug-in hybrid) of all its models. In the same group, Fiat will also be a fully electric brand by 2030, which should be extended to its affiliate Abarth, while Chrysler – also part of Stellantis, which also includes Peugeot, Citroën and Jeep – will only sell electric vehicles from 2028.

Before the end of this decade, the British companies Jaguar and Land Rover will also become 100 percent electric, as the former will stop selling combustion-engine cars in 2025 and the latter will do so a year later. And Ford, which expects half of its sales in the European Union to be electric vehicles by 2026, has chosen 2030 as the date to stop selling combustion-powered cars in Europe. Volvo is similar: the Swedish manufacturer wants to stop selling cars with a combustion engine in 2030 and expects that by 2025 half of its models will be all-electric.

The Renault group wants to put a dozen electric models on the market by 2025, with such striking examples as the reissues of the Renault 5 and Renault 4, the aim being that 90% of sales will be pure electric vehicles by 2030. Although they have not set an end date for producing petrol engines, they have for diesel, which will no longer be offered in 2025. And several Stellantis brands, such as Citroën and Peugeot, could also be saying goodbye to diesel that year.

The Volkswagen Group, on the other hand, has put a date on the end of combustion engine vehicles for their main brands. Audi, for example, recently announced that the launch of its latest car equipped with a combustion engine will take place in 2026, while the end of car production with a petrol or diesel engine is set for 2033. Volkswagen looks likely to miss the EC deadline for offering only 100 percent electric vehicles.

Efficiency

Electric engines are much more energy efficient than combustion engines. Travelling 100 km with an electric car requires about 13 kWh, while a car with a consumption of 5 l / 100 km needs the equivalent of 45 kWh in petrol to travel the same distance. If we add the price difference, a petrol-driven engine spends five times more: 6.5 euros for every 100 km, compared to 1.30 euros for electricity (calculation made with petrol at 1.30 euros / litre and electricity at 0.10 euros / kWh in off-peak demand).

The big downside is autonomy. A 60 kWh battery provides power to cover around 400 km, one of 40 kWh, about 270 km and one of 30 kWh, about 200 km. The lifespan of a lithium battery is between 800 and 1,100 full charge cycles, so it can be used for between six and eight years if the car is driven 75 km a day.

Sales

Last year, 27,769 electric vehicles were registered in Spain, 37.76% more than in 2020, of which 23,686 were passenger cars. In the same period, 6.6 million units were sold on the world market, more than three times as many as in 2019, according to a report by the International Energy Agency (IEA), which shows that 8.5% of the world car market is electric, compared to 0.01% ten years previously. China led the growth, with 3.4 million sales.

Returning to the Spanish market, 3,484 electric cars were sold last month, with a market share of 4.8%, while registrations of alternative vehicles (electrified, hybrid and gas) exceeded those of diesel vehicles in March. The market shares are as follows: petrol-driven vehicles 35%; diesel vehicles, 30.6%; and alternative vehicles, 34.3%. In terms of motorcycles, 6,654 electric vehicles were sold last year, with a market share of 4%.

José López-Tafall, general manager of the ANFAC car and truck manufacturers’ association, points out: “Although demand is growing, it is not at the pace needed to achieve decarbonisation targets and catch up with the major European countries. Spain remains at the tail end of electrification. Efforts need to be stepped up, with more measures to boost charging infrastructure and improve the efficiency of support plans for existing demand.” There are around 150,000 electric vehicles in Spain, which equates to 0.4% of all vehicles, but the goal is to reach 5 million by 2030.

Vans

The former Nissan car and industrial vehicle manufacturing plant in Barcelona’s Zona Franca will be relaunched and transformed to produce one hundred percent electric Zeroid vans manufactured by the Catalan companies QEV Technologies and B-Tech. The goal is to produce around 100,000 vehicles a year from 2025.

QEV Technologies stresses that its aim is to “absorb 100% of Nissan’s workforce” during this period and reach a production rate of 60,000 vehicles a year in three years. For its part, B-Tech intends to relaunch the Ebro heavy and freight vehicle brand to make up the remaining 40,000 vehicles for the new production plan.

At first, the batteries will be imported from Asia, but the goal is ultimately to manufacture them in Spain under a joint project with other companies. The Zona Franca power hub is considering hosting other projects as well, such as a battery approval and certification centre, the manufacture of battery exchangers and a battery development centre, if it receives a subsidy from the Strategic Project for the Recovery and Economic Transformation of the Electric and Connected Vehicle (PERTE VEC).

The call for applications for subsidies was published on March 18, offering a total amount of 2.97 billion euros: 1.55 billion in grants and the rest in loans. Projects must have an impact on at least two autonomous regions, have a participant in each of the three mandatory blocks – battery manufacturer, car manufacturer and component manufacturer – and 30% of each initiative must be linked to small and medium-sized companies.

According to the Spanish government, the employment generated by PERTE VEC could reach 140,000 jobs, with a contribution to GDP of between 1% and 1.7%. Other expected impacts would be to reach 250,000 registered electric vehicles and between 80,000 and 110,000 recharging points by 2023.

Public transport

The Barcelona Metropolitan Transport authority (TMB) has started a tender for the largest ever order for electric buses: eighty-three vehicles for a value of 58.3 million euros, which will join the municipal fleet next year to replace other diesel powered vehicles. The TMB currently has thirty 100% electric buses, and expects to have more than five hundred ecological vehicles (electric, gas or hydrogen) between 2022 and 2025, with the aim that by the end of 2024 the vehicle fleet will be made up only of electric, hybrid and compressed natural gas vehicles.

The eight hydrogen-powered vehicles that are in the process of being delivered to TMB are also electrically powered. They generate energy on the go by reacting the hydrogen stored in their tanks, but they have the disadvantage that it is more expensive than petrol. EVARM, an engineering company specialising in the conversion of traditional professional vehicles to alternative fuels based in Sant Boi de Llobregat, has developed the first vehicle in Spain to run 100% on green hydrogen. The vehicle is about to be approved and the goal is to introduce it to the market in 2023.

The end of the line?

Is this the end of internal combustion vehicles? Not necessarily, because what the EU is aiming for is to eliminate CO2 emissions, and if a conventional engine succeeds in doing that it will take its place on the market. One alternative is engines that run on synthetic fuels, the main advances of which have been made by the Volkswagen Group, and especially Audi, which sees in so-called e-fuels (e-gasoline, e-diesel and e-gas) a second era for combustion mechanics, as they would guarantee CO2 neutrality in their production process based on raw materials such as water (from which they would get hydrogen) and carbon dioxide itself. A curious facet of this is that combustion would generate CO2, but in a smaller amount than the CO2 taken from the air for the manufacture of synthetic fuel, so that the levels of carbon dioxide in the atmosphere would continue to fall. However, according to a study by Transport & Environment, cars running on this “greener” type of gasoline emit higher levels of NOx toxic gases than those of unleaded petrol, as well as much more carbon monoxide and ammonia.

feature Environment

feature environment

feature environment

Workforce changes

Seat manufactured 500,000 vehicles at its Martorell plant in 2020, a figure the company expects to maintain up to 2025, but including three models of electric vehicles from the Cupra, Skoda and Volkswagen brands. To keep the same production levels Seat has already informed the works council that it will have a surplus of between 2,500 and 2,800 staff, as the combustion car requires between 17 and 23 hours of work per unit depending on the model, while that the compact electric vehicle that will be manufactured in Martorell will involve between 12 and 13 hours. In addition, the jobs of 1,000 people – including direct and indirect labour – are also under threat at the Seat Components plant in El Prat de Llobregat, where gearboxes are manufactured, now that the Volkswagen group has decided that the Small BEV engine - a model that will be assembled in Martorell and Pamplona from 2025 - will now be manufactured at an Audi plant in Hungary.

A Boston Consulting report on the impact of the transition to electric vehicles on thirty-one related work families predicts that by 2030 there will be 315,000 jobs in Spain, 29,000 fewer than in 2019. This 8% drop will be due to the loss of production volume and, above all, relocation.

The report stressed that the transition to the electric vehicle will lead to a significant transfer of jobs to sectors such as energy and recharging infrastructure, which will be in great need of labour in the coming years. A training plan will also be needed to adapt workers to the new needs of the industry, and it is estimated that 165,000 jobs will require specific qualifications. In 2020, around 92% of vehicles produced in Spain were equipped exclusively with a combustion engine. This proportion will fall by only 2% by 2030, when the volume of battery and plug-in hybrid vehicles will be around 68% and the remaining 30% will be hybrid electric vehicles. This means an increase in production of 52% per year of electric vehicles with batteries in Spain. The study concludes that the transition will be able to offset job losses due to employment generated in batteries and recharging infrastructure.