Time to relocate

A lack of raw materials and high transport costs are revealing the dangers of depending so much on Asia; it is time for governments to consider what, beyond microchips, needs to be produced on a local level

Galfer is a Granollers company that manufactures brake pads and discs for the main brands of motorcycles, scooters and bicycles. Like other Catalan producers, it is suffering from the lack of raw materials on an international scale, but it is also noticing an increase in the number of orders from companies that were previously buying from China and have decided to make a commitment – or recommitment – to local suppliers. “There’s a forced relocation, and this could benefit many local SMEs,” predicts José María Sánchez, the group’s factory manager. The microchip and raw materials crisis comes at the same time as a sharp rise in the price of transport, especially shipping, which has multiplied more than tenfold. Costs are increasing and flexibility is being lost, so for some companies, producing or buying abroad is no longer so viable.

At the same time, our local companies – and, finally, governments – are realising they have surrendered a lot of power in recent years and that this has consequences. There is currently a sharp mismatch between the supply and demand of raw materials and microchips, but behind the supply crisis there are also geopolitical causes: China is stockpiling the materials it manufactures to protect its industry, which unbalances everyone else. Here, the lack of materials has not only brought the Seat plant in Martorell to a halt, but, according to a study by Pimec, eight out of ten small and medium-sized Catalan companies have supply problems and fear that it will end up affecting them in the productive or labour sphere. We are seeing the most dangerous face of globalisation, and to address it, Europe is now calling for economic and technological sovereignty. The time has come to consider which strategic activities need to be relocated, and experts and entrepreneurs are confident that this great opportunity will be taken to regain industrial weight.

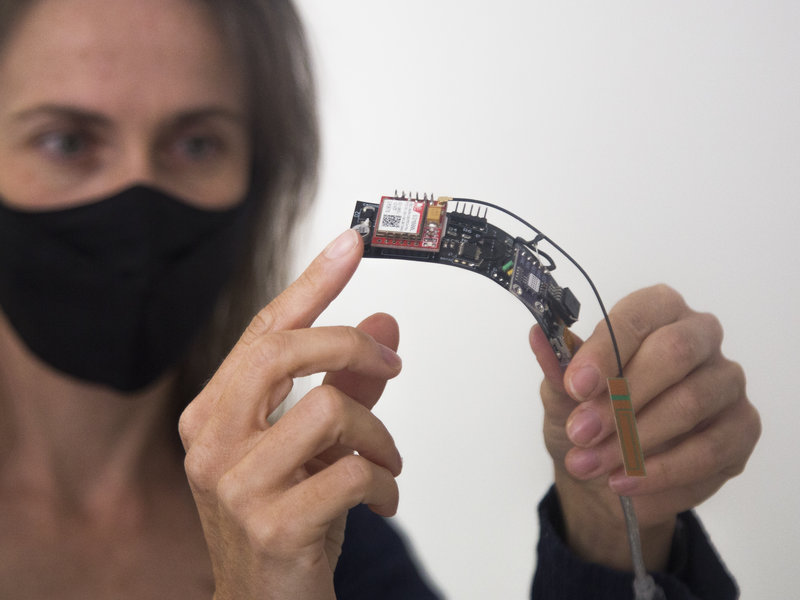

The EU has announced that it will invest 800 million euros to attract Asian and US investment. It wants “megafactories” to be set up on the Old Continent to produce the “most advanced” microchips “on a large scale”. Europe has been losing ground for years – it currently only manufactures 8% of the world’s semiconductors – but now that its large car plants have stalled due to a lack of parts – and many more industries that depend on them are in danger – it is starting to make a move and put some money on the table.

More flexible chains

As Cristian Castillo, professor of logistics and production at the UOC, points out, “before the pandemic, a reflection on the concept of deglobalisation was already on the table, relocating part of the industry that for decades we have allowed to leave Europe and making it as local as possible once again, especially to make the logistics chain for many basic materials more flexible.” The pandemic has made this a “necessity” and not only companies but governments are thinking this, the latter being the ones who have to “implement subsidies to ensure that the difference that forced companies to leave, which is economic, does not have so much weight and thus make it feasible to produce certain products in our territory.”

Castillo makes it clear that “full relocation” is unfeasible and it would even be counterproductive, because we cannot give up the advantages that globalisation has brought us,” but stresses that it will have to be promoted in strategic sectors for the future, such as electric vehicles and sustainable transport. The decisions we take to make microchips here now will not bear fruit until three or five years from now, a waste of time that everyone warns we cannot afford to experience again. “China, which does know where the future is heading and where it needs to go, is now uniting all semiconductor purchases to have them in stock and have the power, while here we get lost in discussions and it takes us too long to make decisions,” the UOC professor laments.

Although he rules out the return of European factories that have left for Asia, he does point out that the Old Continent could attract new investments if “we increase the resources we have, which are considerable.” Asia might manufacture state-of-the-art semiconductors, but the machinery comes from the Netherlands.

Angel Hermosilla, Director of the Economics Department at Pimec, states that “microchip production will be one of the first activities to be relocated,” but warns that we must learn from past mistakes and “must think now about what we will be lacking in three, four or five years time.” “We need to analyse our vulnerabilities. We have set goals like moving towards energy and digital transition, but have not thought about where we will get the resources from,” he says. Unlike Castillo, he believes that companies that once decided to relocate could in fact return.

business

“We will manufacture here using local resources”

The Catalan company i3D Eco Packaging Ideas is trying to depend less on Asia and relocate its production of eco-friendly packaging

Based in Barcelona, the company i3D Eco Packaging Ideas designs and sells sustainable packaging for the food industry, such as recyclable plastic, PET and paper packaging, compostable packaging made from natural fibres, and reusable packaging such as bottles that can be refilled. The company was founded 13 years ago and, although its CEO, David Esteban, had set himself the goal of not purchasing from the Asian market, he had to change strategy in 2015, when the company decided to innovate and make a commitment to new materials.

“I didn’t want to have suppliers in Asia, not because I was a visionary and knew that a crisis as large as the current one would come, with soaring transport prices and a shortage of raw materials, but because I’ve always been an advocate of local purchasing and revitalising local economies.” But the first i3D compostable packaging was made from palm fibre and there is only one factory in the world that makes it, specifically in Malaysia. “From there we moved on to sugar cane, which we also pioneered, and we have to get that from China,” Esteban says. However, changes are afoot. The company is researching how to make organic packaging with materials we have at our disposal in Catalonia, such as tomato or eucalyptus branch and grape seeds, and has an ambitious project to relocate production.

As a first step, starting this month, i3D no longer buys paper cups or salad packaging from China, but from Turkey. “I see Europe as a local market,” says the company CEO, who emphasises that the ultimate goal is to establish an “industrial town” somewhere in Catalonia or Spain and centralise all R&D and production.

“In the first phase, we’ll need raw materials from Asia, but the idea is to end up exploiting local resources; that’s why we want to investigate whether, instead of bamboo or palm, we can use fibre from the tomato branch that can be used for food packaging and move forward. Maybe we can also make use of the grape or eucalyptus branch, which are very common in our country and grow very fast,” reflects Esteban. The idea is to start the industrial village project next year. The i3D CEO is already seeking funding to raise two million euros to capitalise the company and he predicts that there are Asian suppliers willing to inject capital. “They’re also interested in being in Europe,” he says.